If you’re in the profile extrusion business and focus on the window and door market, you are pretty much riding the ebbs and flows of the construction industry. That wasn’t an enviable position to be in during the economic crisis of 2008-2009, when the construction bubble burst, so Intek Plastics is doing something to prevent a recurrence. In a word: diversify. Based in Hastings, Minn., Intek is taking its nearly 60 years’ worth of expertise in developing customized window and door profiles to new markets, not with “me-too” extrusions but with products developed in collaboration with customers to provide new solutions in lighting, refrigeration, power management, and more.

Intek has been in business since 1961. It is still a privately held, family-owned company, with second- and third-generation family members now in ownership positions. Its roots are in the fenestration market, and it has no plans to abandon that position. Instead, Intek is leveraging its know-how in materials, engineering, technology and good-old-fashioned sit-downs with customers to drive innovation in additional markets.

Notes CEO Jill Hesselroth, “An important initiative for us now is to diversify into other markets. That does not mean we should veer from our core, but it does mean our portfolio should be more balanced. There is no such thing as a ‘mature market’ where we think we can just sit back and watch sales roll in. Even in a market where we have a dominant position, we continue to invest in R&D with our major customers to explore the potential of new materials and work with customers side-by-side through their product-development cycles to bring new products to market. This requires a continuous commitment to strategic customer relationships, R&D, and delivery of excellent products backed by excellent service.”

Intek has staffed up for this market expansion: It brought in Paul Pedersen as v.p. of sales and marketing in 2017. About a year ago, it hired Lee Johnson as business development and market manager for lighting, signaling the company’s strong commitment to become a major force in customized profiles for the burgeoning LED market.

While Intek’s growth in new markets figures to be organic, it has made some acquisitions to speed up the process. In 2008, it acquired Elite Plastics, Hawthorne, N.J., a profile extruder that focused on the point-of-purchase (POP) market. Last year, Intek bought the customer assets and production tooling of Hall Manufacturing Corp., Ringwood, N.J. Says Hesselroth, “Hall’s business was less than 50% in POP, so with this purchase we were looking to diversify in Hawthorne.”

At first blush, it might seem unusual that a processor with a long history in windows and doors—generally considered a high-volume business in which the same products are made all day, every day—would even be in a position to think about diversification, but Intek’s business has always been truly custom. Within the core fenestration business, it does not have its own line of products, but instead tackles the specialty projects that its customers are not geared to run themselves. Explains Rick Zeien, director of operations, “In fenestration, all of our production is for major window and door manufacturers. But these are custom, challenging profiles that the customer can’t run at the super-high volumes they are set up for, and that’s where we fit in. ”

For some, fenestration conjures up the notion of a processing operation devoted chiefly to PVC. Not so, says Zeien. Granted, the 150,000 ft² plant in Hastings has three Milacron twin-screws—a 55-mm and two 65-mm—that run primarily vinyl. But “windows and doors are not just PVC, and we run quite a bit of TPEs, TPOs, ABS, filled PPs, TPUs, and other materials for fenestration,” he states. The company also does extensive proprietary material formulating to tailor compounds to particular applications.

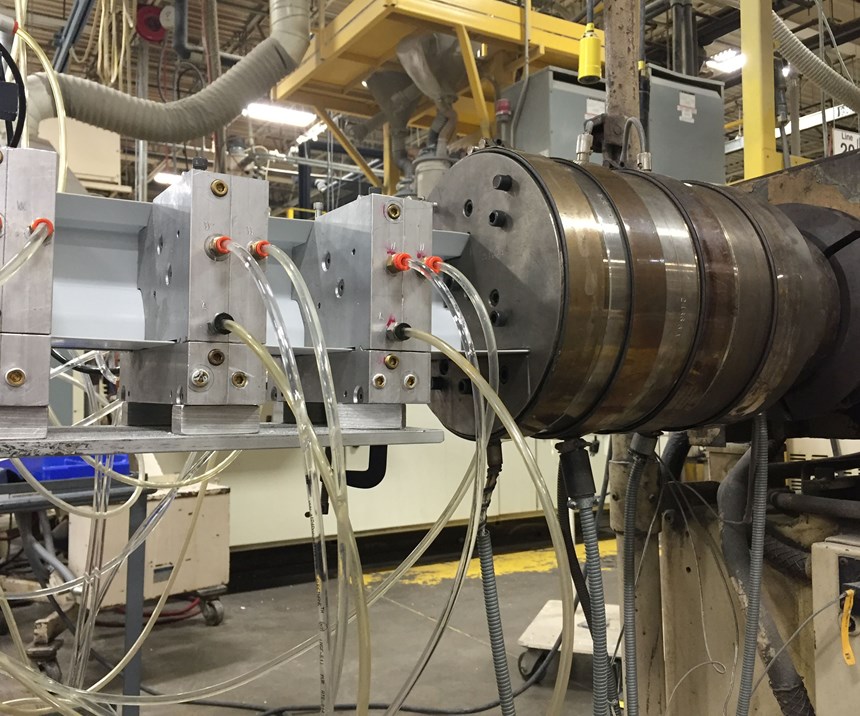

Intek runs 34 production lines in both plants and has two new complete single-screw lines from Davis-Standard on the way to Minnesota. Its single-screw machines range in size from 2.5 to 3.5 in., with coextruders from 1 in. to 2.5 in. Intek runs profiles ranging from less than ¼ in. to over 10 in. in size. It operates on a 24/5 basis.

Coextrusion technology is a staple at Intek. The firm holds several coextrusion patents and can run up to four materials into one multi-durometer profile. A patented product tradenamed ARLOC is a TPE weather-stripping for residential windows and doors, which incorporates a coextruded, friction-reducing slip coating.

Manufacturing at both Hastings and Hawthorne is supported by tooling designed and built in-house. Hastings is equipped with two EDMs as well as vertical machining centers, hole poppers, and assorted other metalworking equipment. Companywide, Intek has more than 900 active tools. Tool builds extend beyond the die; Intek also fabricates calibration tooling and assorted devices that allow for in-line fabrication. These include tools for hole-punching, notching, routing, printing, embossing, and insertion of weather strips, foam and more. Notes Hesselroth, “We’ve migrated our technology to meet the demands of customers that want to pull their product out of the box and be ready to install.”

The 35,000 ft² New Jersey plant focuses more on shorter runs and quicker turns for the POP and retail markets. Over the years, Zeien notes that Intek has leveraged its coextrusion know-how in Minnesota to help make the Hawthorne business more flexible. Intek believes that having two operating models allows it to service more customers more effectively. “We’ve learned that having two complementary ways of servicing our customers opens up new possibilities for us, as every market and every customer can have different needs and priorities,” states Hesselroth.

In short order, Intek will accept delivery of its first 3D printer. Says Zeien, “Over the years we have been going outside to use third-party services for this.” He notes the printer will be used not to prototype tooling, but to prove out design concepts for finished products.

Intek has received quality ratings from customers as high as 99.99%. That said, it is continuously looking for ways to improve its processes, says Hesselroth. “We are always looking at ways to add automation,” she states. “We’ve just recently put out weigh stations that automatically count pieces that go into boxes, on-line. Having the correct count is critical as more customers have adopted lean manufacturing strategies.”

On the quality-control front, Intek uses several Starrett Bytewise laser-profile measurement systems that can input directly into immediate SPC calculations. The system lets customers access their projects for status updates in real time.

ENLIGHTENING THE LED MARKET

Over the years, Intek had developed a small amount of business in the lighting market, mostly as the result of being responsive when an existing customer approached it about a new project. “We did some research last year on the lighting market,” notes Pedersen. “We focused on the needs and challenges in this growing market. LEDs are in strip form, which fits perfectly with profile extrusion.”

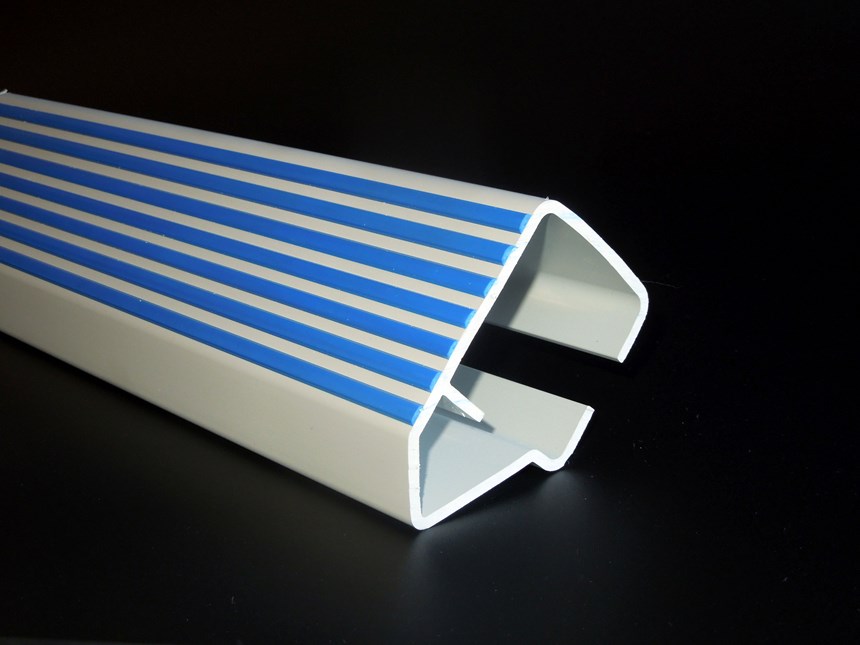

Of course, not all profile extrusions are the same, and expanding from fenestration into lighting requires more than a tooling change. “It’s all profile extrusion, but there are differences, and these differences challenged the operation,” notes Pedersen. So Intek responded. Now, Intek’s Hastings operation dedicates extrusion lines specifically to lighting—including upstream drying and conveying—to avoid cross-contamination, because lighting materials are commonly hygroscopic. In lighting, Intek runs PC, acrylic, and transparent and reflective PVC. “We are coming to the party with a lot of materials expertise,” notes Johnson, “and with coextrusion capabilities new to the LED market. The lighting market is dynamic. New lights and fixtures are being developed on a regular basis. Things change in lighting at a fast and furious pace.”

Says Zeien, “Our strength in developing coextrusions comes into play when designing a reflective or transparent lens. Or we can coextrude a material that will allow a lens to be more easily installed or to keep water out of the fixture.”

Johnson adds, “Our objective is to lead the market, to collaborate with customers, to talk to them about properties, materials, to show proof-of-concept profiles. The fact that we can produce one profile from four different extruders is a real differentiator for us. We’re working with customers to educate them so they can make the best decision for their application as to what materials to chose. Adds Hesselroth, “We are in the position to take what we’ve learned in one market and bring it to different markets. We are cross-pollinating technologies. As we learn about material characteristics in one market, we can bring them to others.”

“In lighting, appearance is everything,” says Johnson. “Of course appearance is critical in fenestration and in everything else we do, but when you extrude lenses for LED lighting you are entering a whole other dimension. How do we get that extruded lens to be clear? Or, how do we get it frosted...and to the right level? LEDs are point sources of light; customers may have LED strips where the LEDs are close together, and the lens farther away from the LEDs. In that case you don’t need much frost. Or maybe the LEDs are farther apart and closer to the lens. There, you need more frost. So, collaboration with customers is crucial.”

Adds Zeien, “One customer’s standard for light transparency and frost levels may be completely different from another customer’s. This was a big hurdle we had to get over. That’s where our extensive knowledge of materials and blending of different materials comes into play. That’s one of the ‘secret sauces’ that allows us to achieve the properties our customers are seeking.”

There are other challenges as well, Johnson notes. Of course, the profile must be sized correctly to fit the light fixture. “But it also might have to slide in or pop into a mechanical portion of the fixture, and look good, which is subjective, hard to calculate, and requires lots of collaboration.”

Hesselroth recalls an occasion last year when it received an unexpected call from customer that needed a new product to display in its booth at a lighting trade show. “They came to us five to six weeks out from the show. They ended up changing the design three times. Within those six weeks we got them their part. We reacted quickly. We helped them introduce an altogether new product and as a result got the order to produce it. That was a huge win for our development team.”

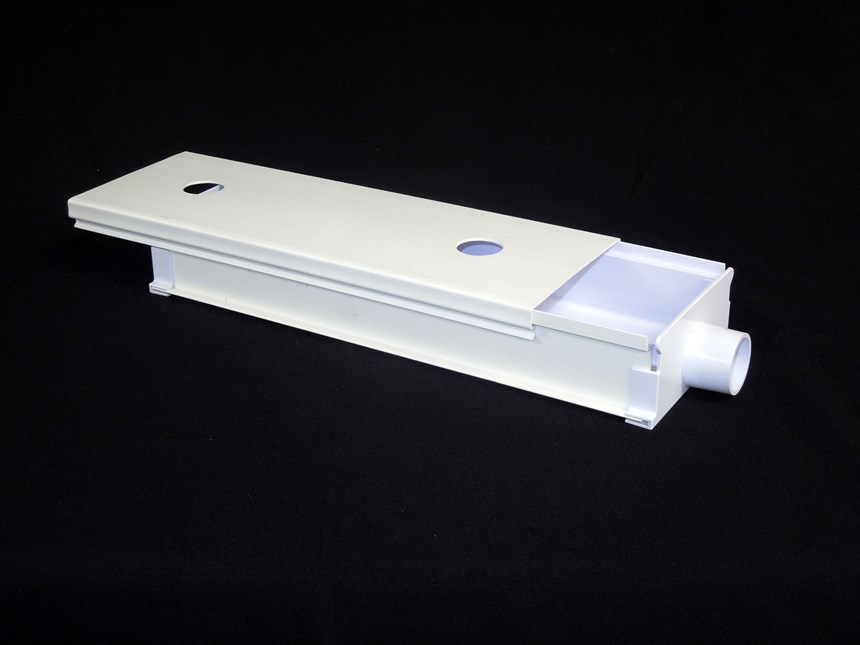

The firm also is investigating lighting opportunities in the agricultural market. Here, Intek leveraged its coextrusion know-how by supplying hydroponic growing trays made primarily of recycled material with a thin capstock on the contact surfaces made from NSF-certified material. This application also required molded end caps, so Intek researched, specified and sourced that part with a nearby injection molder to ensure the entire system fit and worked well together.

Intek has also made inroads in numerous other markets. For power-management markets, Intek offers what Johnson describes as “a niche of extrusion materials” used for bus bars in data centers. In refrigeration, it has begun supplying OEMs with frames and rails that keep cool air from escaping through the doors. It also extrudes kick plates, fascia, bumpers and a range of other products. Notes Pedersen, “A lot of what we do in do in fenestration transfers to refrigeration, notably coextrusion.”

While these new end markets appear disparate, Intek is always on the lookout for synergies. Johnson cites the example of aerospace: “Airplanes use lots of lineals and trim and have a lot of opportunities for lighting. You’d be surprised where lights are being put these days—in the door itself, even in window frames. There are lights now on refrigerator door handles. We’ve even quoted lighting that is muddled into wall board.”

The numbers suggest that Intek’s diversification plan is having the desired impact. In 2018, new market business expanded by nearly 40% vs. 2017. Says Hesselroth. “We tell our customers that when we do business together, they will experience tangible benefits from our high quality, commitment to delivery, collaborative design support, and broad extrusion and fabrication capabilities. Our approach builds strong relationships through hands-on engagement.”

Related Content

Compact Hybrid Injection Molding Machine Launched

Sumitomo Heavy Industries Ltd. (SHI) has introduced the iM18E, promising the smallest footprint in 20-ton machines.

Read MoreNew Cleanroom-Rated Static Eliminator

Neutralize static hands-free in sensitive medical, pharmaceutical and electronic manufacturing operations.

Read MoreUltrashort Pulse Laser Marking System for Medical Devices and More

FOBA’s F.0100-ir creates deep black markings on medical plastics, stainless steel and titanium.

Read MoreAsahi Kasei and Mitsui to Collaborate on Biomethanol Supply and Procurement Systems

Asahi will use the biomethanol to produce engineering resins such as acetal.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More

.png;maxWidth=300;quality=90)