PE Film Market Snapshot 2020: Bubble Packaging

Continued trend toward e-commerce is driving growth in the market for bubble packaging.

This is the fifth in a series of blogs based on 2019-2020 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on key markets for processors of polyethylene film. There will be 10 articles in all, two a week. The first five will offer Mastio’s analysis—based on interviews with processors conducted direct by the Missouri firm—with film processors representing the five largest PE film markets. The second batch of five will be focused on the five fast-growing PE film markets.

The first of these blogs analyzed the stretch film market. The second focused on consumer/institutional product liners. The third discussed T-shirt bags. Last week, we looked at the institutional can liner market, and earlier this week consumer trash bags, based on Mastio’s findings. Here we focus on Mastio’s findings in the bubble-wrap market, which is among Mastio’s five fast-growing PE film market segments.

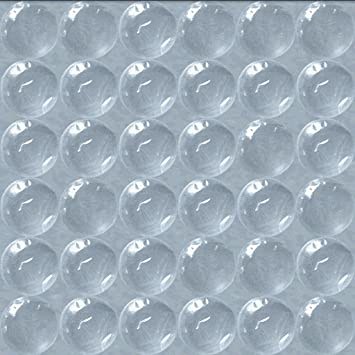

Bubble packaging refers to PE based film designed for protective packaging. The market is divided into two main categories:

Cellular Wrap: Cellular wrap is categorized as film in which small air pockets, or bubbles, are formed between two laminated substrates after film extrusion. Quilts or quilt cushions are also terms categorized under cellular wrap and are constructed with larger air cushions giving them a quilt-like appearance. The primary function of cellular wrap is to protect packaged goods and act as an impact absorber. Cellular wrap typically comes in sheets and protects breakable products from damage when shipped in cartons, crates, bags, and pouches. Cellular wrap is also used as an inner laminate layer in paper and plastic envelopes. Cellular wrap can also be utilized to protect against static electricity and odor. The use of cellular wrap reduces damage and related costs.

Void Fill: Void fill, also known as air pillows, air cushions, square bags, or air tubes, create excellent protection and efficient void fill. Void fill is typically inflated at a packing station and reduces cube cost for shipping and storage. It also creates a good fit inside the shipping package, minimizes dimensional weight charges, limits movement, and prevents damage.

The Numbers

During 2019, approximately 234.7 million lb of PE resins were consumed in the production of bubble packaging in North America. With an average annual growth (AAGR) rate of 6.7%, total PE resin consumption for this market is expected to reach 285.7 MM lbs. by 2022.

Of the total, cellular wrap represented 126.4 million lb, or 53.9% of the market. Void fill represented 108.3 million lb or 46.1% of the bubble packaging PE film market in 2019. With an AAGR of 7.4%, cellular wrap is expected to increase to 156.8 million lb by 2022. The void fill market segment is expected to increase to 128.9 million lb with an AAGR of 5.9% by 2022.

Cellular wrap is generally differentiated by bubble height. Standard bubble heights range from 1/2 in. to 1/8 in., with 3/16 in. being most common. Most industrial cellular wrap is sold on rolls in typical lengths of 1000 ft2 for 1/8 in., 500 and 750 ft2 for 3/16 in., 375 ft2 for 5/16 in., and 250 ft2 for 1/2 in. Retail cellular wrap is sold on rolls in typical lengths of 500 and 1500 ft2 for 1/8 in., 300 ft2 for 3/16 in., 188 ft2 for 5/16 in., and 125 ft2 for 1/2 in. Film widths depend upon the specific requirements of the end-user. Thickness of bubble packaging film ranges from 1 mil to 6 mils, with 2 mils being the most typical gauge.

Void fill is available in a variety of sizes. Some air pillow or square bag sizes include 4 x 4 in., 6 x 7 in., 8 x 5 in., 8 x 8 in., 8 x 12 in., 10 x 4 in., 10 x 6 in., 10 x 10 in., and 12 x 12 in. Other manufacturers advertise air pillows in 8-, 10- and 12-in. widths. Thickness of air pillows can be 1, 1.1, 1.2, 1.4, 1.5, 1.8 mils, and up to 2 mils. An air tube can have a 14-in. tube width while inflated and is perforated between each tube. Air tube thickness is typically 1.5 to 1.54 mils.

The Players

Mastio profiled seven companies that produce PE bubble packaging film in the U.S. and Canada. During 2019, the two largest participants in the bubble packaging market were Pregis Holding II Corp. (Pregis North America Div.) and Sealed Air Corp. Collectively, they consumed approximately 109.5 million lb of PE resin for this market during 2019. The remaining participants processed 125.2 million lb for this market.

The Resins

In 2019, LLDPE-butene, LLDPE-hexene, LLDPE-octene, and LLDPE manufactured with the metallocene single-site catalyst process (mLLDPE) were utilized in the production of bubble packaging film. Hexene, octene, and metallocene grades of LLDPE resin are used to improve puncture resistance and tear strength properties. Post-industrial scrap is utilized in air pillows and some cellular wrap without losing its superior strength. LDPE-homopolymer resin is utilized alone, in blends, or within multi-layer coextrusion with other resins because of the material’s high clarity, ease of processing, and heat seal capabilities.

Some processors claim it is economical to use coextrusion to enhance film downgauging, which has become more common over the past few years.

Lastly, medium molecular weight-high density PE (MMW-HDPE), high molecular weight HDPE (HMW-HDPE), and recycled post-consumer MMW-HDPE (PCR-MMWHDPE) resins were all utilized in the production of bubble packaging for extra film strength in thinner gauges and high barrier properties; predominately in the void fill category.

Processing Trends

A little more than half of the PE film used in bubble packaging was produced via the cast film process, due to the need to form bubbles in the film after extrusion. Often a layer of metalized polyester film, nylon film, foil, or anti-static polycarbonate film is coextruded or laminated with a layer of PE film. The non-PE substrates act as an additional barrier against air loss due to pressure and passage of time. Nylon film was reported as being 100 times more resistant to air passage than PE film, affording greater resistance to air loss.

The blown film extrusion process was also utilized in the bubble packaging market during 2019 and is more popular in the void fill category.

Bubble packaging film can be monolayer or multi-layer coextruded structures. For this market, multilayer coextruded film is typically extruded in three- to five-layer constructions. Some processors claim it is economical to use coextrusion to enhance film downgauging, which has become more common over the past few years. However, most bubble packaging manufacturers believe it is not cost effective to coextrude more than five layers of film in this market.

The Future

Every participant in this market stated that the increased volume of internet sales and e-commerce business has provided an excellent growth opportunity for this market, as many of the items purchased by consumers on the internet require shipping and protective packaging. Online ordering has become a popular trend in shopping, especially during the holiday season.

A significant trend in the bubble packaging market is the dimensional weight (DIM weight) changes with United Parcel Service, Federal Express, and Amazon. These companies have moved to a DIM weight charging method, which has forced shippers to use the smallest box possible with the most protection. Utilizing a smaller shipping box leaves less room for protective packaging and reduces space for void-fill such as air pillows. Smaller boxes also create the need for a higher performing air pillow.

One industry source claims that by the year 2023, biodegradable packaging may be the only option discussed.

However, one industry source explained that the void-fill market segment has peaked and may even shrink some in the next few years. Some products that are not considered fragile may not use any void fill. Over the past few years void fill increased at a faster growth rate than cellular wrap. However, over the next year, the use of void fill is expected to shrink since shippers are now reducing the carton size and moving to cellular wrap cushioning vs. void fill.

Several participants view sustainability as a necessity. One source claims that sustainability is at the heart of everything they do. Many companies have hired new managers to lead their sustainability initiative. Some manufacturers’ sustainability goals center around reducing their carbon footprint, re-imagining customer solutions, and benefiting society.

Furthermore, sustainability has resulted in the talk around biodegradability. The term biodegradable refers to the degradation process of plastic waste. Consumers like the idea of biodegradable products until they learn about the higher priced material used.

With the big shift to plant-based, biodegradable packaging, new bio-based materials are coming online. While starch-based and corn-based materials have been around longer, pea-based and soy-based materials are now being developed. One industry source claims that by the year 2023, biodegradable packaging may be the only option discussed.

Related Content

Variable-Diameter Air Ring Cools Film Above Frost Line

Tower-mounted adjustable ring adds cooling so that blown film can run at optimum line speeds with structures having soft inner skin layers that tend to block.

Read MoreFiltration System Helps Film Processor Manage Recycled Material Mandates

Global film processor RKW teams with Nordson to enable it to process blown film with high recycled content.

Read MoreFilm Extrusion: Boost Mechanical Properties and Rate of Composting by Blending Amorphous PHA into PLA

A unique amorphous PHA has been shown to enhance the mechanical performance and accelerate the biodegradation of other compostable polymers PLA in blown film.

Read MoreGreen’s the Theme in Extrusion/Compounding

The drive toward circular economy is requiring processors to make more use of PCR. Machine builders at K—across all extrusion processes—will be highlighting innovations to help them do just that.

Read MoreRead Next

PE Film Market 2020 Snapshot: Stretch Film

Stretch film accounted for 2.4 billion lb of PE of resin consumption in 2019, making this sector one of the largest and fastest growing markets within the PE film industry, according to Mastio’s research. The top five players hold about 80% of the market.

Read MorePE Film Market Snapshot 2020: Consumer Trash Bags

Trash bag market dominated by major players. Average annual growth pegged at 3.4% for the next three years though environmental issues loom.

Read MorePE Film Market Snapshot 2020: Institutional Can Liners

Market is about 1.37 billion lb strong now, and is expected to grow by 2.6% through 2022.

Read More