PE Outlook for 2016 Favors Processors

After years of not having the advantage, RTi's Burns says processors are poised to see a reversal.

I have the opportunity of sharing an outlook on how the PE market is likely to shape up for 2016 thanks largely to Mike Burns, v.p. of client services for PE at Resin Technology, Inc. (RTi), Fort Worth, Texas. Mike, for one, projects that this will be the first time in years that processors will participate in a resin market where they have the advantage. “Processors should expect low resin cost (relative to the five-year average), ample inventory, and an aggressive buyers’ market.

Let me say that our monthly resin pricing analysis column has for some years now benefited from the views and outlooks shared with us by key resin purchasing consultants at RTi for four commodity thermoplastics--PE, PP, PS, and PVC, and quarterly updates on the four commodity engineering resins—ABS, PC, nylons 6 and 66. That also applies to the expertise and reporting shared by CEO Michael Greenberg of Chicago-based The Plastics Exchange, with an emphasis on the spot polyolefins markets. More recently, I have started to include information shared with us by Houston-based PetroChemWire, which we are looking forward to continuing. Also, from time-to-time, based on conferences and webinars offered, I have reported on the projections of key consultants at Houston-based IHS Chemical.

On Nov. 3, I blogged about the outlook for PE within the next five years that was presented at GPS2015 by Nick Vafiadis, global business director of plastics & polyolefins at IHS Chemical. Let me just mention his key points for end of 2015 and 2016. He noted that prices would remain flat through year’s end and into the first part of first quarter; placed total demand increase through third quarter at 4.5%; and, average PE plant operating rates at 94.4%, in what has been a well-balanced market.

But he projected change coming. The first one by end of first quarter, with PE prices likely to increase by 3ȼ/lb, driven by tighter ethylene supply due to a heavy first quarter cracker turnaround schedule. But, the big story, starts in the subsequent two quarters when new production from new entrants comes on stream fully, and Vafiadis predicts PE prices dropping. With regard to HDPE, in particular, Vafiadis anticipates that prices may separate from other resins due to increased competition. Vafiadis’ key takeaway to PE processors: leverage competition and reduce contract commitments leaving room for spot purchases.

The 2016 PE outlook shared by RTi’s Burns is somewhat on the same page, though he does not see PE prices moving up due to the planned ethylene cracker turnarounds. He points out that 65% of global PE is made from crude oil derivative naphtha and maintains that North American PE suppliers will have to price their resins within 10ȼ/lb of the global price to keep imported finished products and exported resin markets balanced. As such, the RTi oil-pellet formula should continue to gauge pricing with oil changes; every $10/bbl change in either direction equates to a 4-5ȼ/lb in PE prices. Here are some other key points in Burn’s 2016 PE outlook:

• Short-term, first quarter 2016: The most recent change in the global PE markets will be the impact of continued price decreases in China. Currently, the Chinese PE price is now at the lowest since first quarter 2009, and only 5ȼ/lb above the low in fourth quarter 2008. He points out that soft demand and lower oil prices will continue the downward pressure in China and Southeast Asia. “North America may have to respond to the lower pricing if the trend continues.”

• Overall 2016 North American PE prices: Expect suppliers to continue to push for price increases. Without any global drivers present to support increases, opportunistic events may be their only possibility of succeeding. Burns advises processors to manage their inventories as needed and keep their eye on oil prices. Centered on the average price of oil since September 2015 of $45/bbl, Burns ventures that 2016 PE prices are likely to average 4ȼ/lb over the December 2015 price based on oil prices in due course, moving to the high $50’s/bbl. He expects suppliers to become very aggressive as the 2017 contract negotiations are initiated toward end of next year. Their main concern: losing market share to another supplier.

• Supply/Demand: Steady demand growth in 2016 will not surpass the new capacities expected in the next two years. North American expansions for 2016 include Nova Chemicals with 400 million/lbs of LLDPE and Ineos/Sassol with 450 million/lbs of HDPE. According to Burns, the 45-billion/lb North American PE market already exceeds demand by nearly 20%. (He pointed out that just last month, there was a build-up of supplier inventories despite the fact that exports were up.) Moreover, he notes that Braskem’s Mexico expansion of 2-billion/lbs coming on stream next year, will directly impact North American LDPE and HDPE exports into Mexico and Latin America.

• Operating rates: The low cost of production in North America will continue to support 90%+ operating rates. PE suppliers will take advantage of the higher global resin price and export any incremental volume. Suppliers have historically produced around 90% of capacity…it is unlikely that production rates will decrease with new investments adding capacities.

• Supplier inventory: Inventory levels will continue to be healthy as supply improves nearly 7%, outpacing expected North American demand. The lowest inventory data for 2015 was higher than the highest points from the two previous years. PE inventories have improved after a year of limited disruptions.

• Supplier Margins: Profit margins for PE suppliers will remain healthy in 2016. The cost to produce and deliver PE pellets from the integrated supplier is below 33ȼ/lb.

• Exports: Domestic PE exports will continue to be the main outlet for incremental volume. The three-year average has been near 20% of production. As production increases, exports will have to keep pace equalizing inventories. North American suppliers will have to offer prices that are near the prices of the “oil pellets” offered from Thailand and Korea to compete. Latin America and Mexico will be the preferred destination, procuring over 65% of the export volume.

Related Content

Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

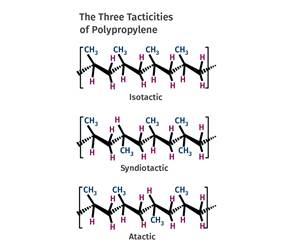

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More

(2).jpg;maxWidth=300;quality=90)