Price Hikes Underway for PE; One Could Emerge for PVC

PCW’s weekly reports for PE and PVC offer a glimpse of what’s shaping up for August and beyond.

As the first week of August came to a close, PetroChemWire (PCW) released its weekly reports including the PE Weekly and the PVC & Pipe Report. Here are the key takeaways:

PE: Starting with PE contract news is definitely a mixed bag. PCW’s Senior Editor David Barry confirmed that July was a rollover and that PE suppliers were now pushing to implement their 3¢/lb increase in August. Moreover, two suppliers have announced an additional 4¢/lb increase, effective September.

In the spot market, meanwhile, PE prices were flat-to-higher amid balanced-to-tight supply. August export prices initially were seen at a rollover to a 3¢/lb increase but Barry characterized volume as light amid spotty availability and soft demand in Latin America. It is believed that suppliers’ inventories saw a significant decline in July owing to production outages coupled with strong domestic demand.

In operation news, Barry reports that Formosa had lifted its force majeure on PE. Nova Chemical, on August 5, was due to start a plant turnaround at its St. Clair, ON site (approximately 397 million lb/yr), with restart scheduled for early November. This is part of a broader maintenance program that includes all of the PE/olefins capacity at this site and one LLDPE unit in Joffre over the next three months.

In other industry news, Westlake reported that its olefins segment had a $36.5 million decline in operating income in second quarter. This was attributed primarily due to lower PE sales and costs associated with maintenance on one of its PE units. Westlake officials noted that China’s scrap ban would boost prime PE demand. Yet, it has also been reported elsewhere that China’s expanding domestic PE capacity is likely to replace the recycled PE volume, resulting in limited international impact.

PVC: Senior editor Donna Todd confirmed that Formosa’s VCM outage at Point Comfort, Texas continued to dominate the ‘conversation’ in the PVC market, with both processors and competitors wondering how long the unit would be down. Driving the concern is the week before, the company declared force majeure on its Formolon 608, 614, 616K, 622R and 622S grades of PVC. According to PCW, competitors confirmed that this declaration protected all of Formosa’s pipe grade customers, who are to receive their normal deliveries this month, but left other customers getting as little as 50% of their normal deliveries. Repairs are reportedly now underway with restart of the plant expected between late August to sometime in September, PCW reports.

Now on contract pricing. Had this disruption not taken place, processors would have enjoyed a drop in PVC prices owing to falling ethylene prices. Instead, they have been concerned that PVC suppliers would use the Formosa outage and PVC force majeure to push prices higher. While August PVC contract prices remained flat, easing concern for some processors, others believe that a price increase announcement could emerge mid-month with an effective Sept. 1 date, reports Todd.

Such an outcome could be realized if an outage that took place at Shintech’s Plaquemine, La., VCM 2 unit on August 5, ends up affective the company’s PVC production, she notes. The outage took place when a pipe ruptured in the VCM 2 plant’s furnace quench area. According to PCW, a Shintech source on Monday stated that the rupture and leak were not having any impact on its business at the moment. Customers confirmed they had not been notified of any changes in their deliveries.

Related Content

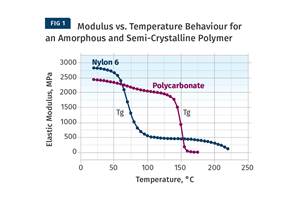

The Effects of Temperature

The polymers we work with follow the same principles as the body: the hotter the environment becomes, the less performance we can expect.

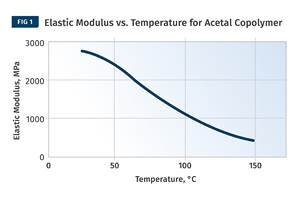

Read MoreThe Effects of Time on Polymers

Last month we briefly discussed the influence of temperature on the mechanical properties of polymers and reviewed some of the structural considerations that govern these effects.

Read MoreUnderstanding the ‘Science’ of Color

And as with all sciences, there are fundamentals that must be considered to do color right. Here’s a helpful start.

Read MoreResin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More