Your Business Outlook - December 2008

Wire & Cable Outlook: Slow for Another Year

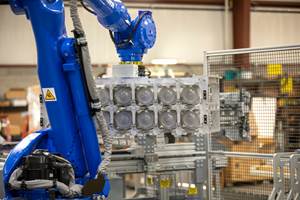

Already a familiar sight on European store shelves, the eye-catching appeal of "IML" is gaining traction among North American injection molders. The latest tooling and automation designs can handle the higher volumes needed here.

Data compiled by the Federal Reserve Board indicate that U.S. production of wire and cable was up about 2% for the first three quarters of 2008 compared with the same period in 2007. Unfortunately, all of this growth occurred in the first half of the year, as the market for wire and cable quickly lost momentum in the second half. As with most of the industrial sector, demand for wire and cable will wane through the first half of 2009. Our forecast is for output to be flat in 2008 followed by a decline of 6% in 2009.

NOW FOR THE GOOD NEWS

Yet despite sluggish demand over the next few months, the good news is that materials prices for wire and cable have dropped precipitously. Resin prices peaked in the third quarter and are now in a downtrend. Resin prices correlate closely with the price of crude oil, which a month ago were down more than 50% from their peak last July. Long-term fundamentals currently favor continued moderation in oil prices, and if efforts to cut U.S. oil consumption are sustained, the result will be further price declines.

Prices of nonferrous metals such as copper also experienced a steep decline in recent months. Copper prices hit a peak last summer, but are down 55% since. The recent downtrend in prices is due to sluggish global demand, but recent efforts to increase energy production through means such as wind and solar will increase future domestic demand for wire and cable.

As the chart illustrates, the last major surge in demand for wire and cable occurred in 2000. This was mainly driven by new communications projects that were part of the high-tech explosion that included the dot.com bubble, Y2K, and flourishing of cell phones and PDAs. A lot of overcapacity was installed at that time, which has suppressed demand for wire and cable ever since.

The point for wire and cable extruders to remember is that market demand is affected by cyclical patterns in three major end markets: durable goods manufacturing, residential construction, and non-residential construction. The non-residential sector has been the strongest so far this year. It is up 10% through the first three quarters, but the growth is losing momentum as the year comes to a close. All three of these sectors will remain sluggish through the first part of 2009, but by late next year, a new cyclical uptrend will be established in the U.S. economy. Shortly thereafter, wire and cable production will begin to register consistent monthly increases.

This means that it will be 2010 before the curve for wire and cable products rises above the levels of the past seven or eight years. It will take at least another year before the manufacturing and construction sectors begin to expand again at levels that will justify sustained investment in the type of infrastructure projects that generate strong growth in wire and cable. The energy-producing and distributing markets will be one catalyst for this growth, and the markets for new types of building materials and machinery components will also become more developed. It is still too early to know if the curve for wire and cable will ever return to the levels seen in 2000 and 2001, but once the uptrend gets started, the industry should enjoy three to four years of positive growth.

About the Author

Bill Wood, an independent economist specializing in the plastics industry, heads up Mountaintop Economics & Research, Inc. in Greenfield, Mass. He can be contacted by e-mail at BillWood@PlasticsEconomics.com. His monthly Injection Molding and Extrusion Business Indexes are available at www.ptonline.com.

Related Content

50 Years of Headlines … Almost

I was lucky to get an early look at many of the past half-century’s exciting developments in plastics. Here’s a selection.

Read MoreAn Automation 'First' for Non-Servo-Eject Trim Presses

Compact, flexible and configurable robotic system is said to be the first to enable thermoformers to fully automate product handling after a non-servo trim press.

Read More50 Years...600 Issues...and Still Counting

Matt Naitove marks his first half-century in plastics reporting, with a few of his favorite headlines.

Read MoreFive Ways to Increase Productivity for Injection Molders

Faster setups, automation tools and proper training and support can go a long way.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More