Resin Buying Strategies: Resin Prices Head South

Lower prices for all four major commodity thermoplastics were the trend from late April to mid-May, with good potential for further downward movement this month and beyond

Lower prices for all four major commodity thermoplastics were the trend from late April to mid-May, with good potential for further downward movement this month and beyond, according to purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas. Improved ethylene and propylene monomer supplies and sharp price drops are key factors.

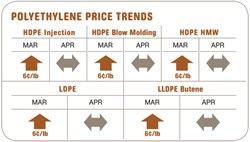

PE PRICES SOFTEN

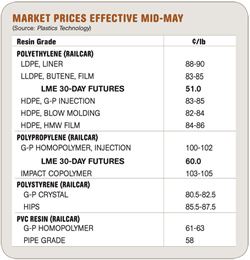

Polyethylene prices remained flat through April and were beginning to drop in May. The London Metal Exchange (LME) North American short-term futures contract for butene-LLDPE film grade in May dropped 8¢ to 51¢/lb.

As ethylene availability began to improve, spot monomer prices dropped from their peak of 74¢/lb in April to under 50¢ by mid-May. Except for some specialty grades, PE availability also improved. Although resin demand was up in the first quarter, it tapered off dramatically in April.

Suppliers’ operating rates were at 70-73% for LDPE, 97-98% for LLDPE, and 85-87% for HDPE. Demand rates stood at 90-92% of capacity for LDPE, 96-98% for LLDPE and, 86-88% for HDPE. Exports dropped to unusual lows in both March and April, but appeared to be rebounding with the start of the farming season, increased Asian resin prices, and falling U.S. prices.

Outlook & Suggested Action Strategies

30-60 Day: Continue to buy as needed since prices will be lower. The start of an improved export market is likely to be the leading indicator of when the PE price decline will bottom out.

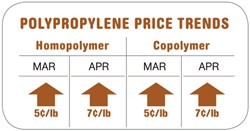

PP PRICES DOWN

Polypropylene contract prices moved up 7¢/lb in April, a partial implementation of anounced 11-12¢ price hikes. Spot PP tabs were also up 7¢, but there was very little buying activity last month. Meanwhile, LME short-term futures in May for g-p injection-grade homopolymer dropped 9¢ to 60¢/lb.

In mid-April it became apparent that propylene monomer prices were going to fall in May. This kept many buyers out of the market and drove down overall demand. PP suppliers found themselves with excess inventory and slashed prices to move the pounds. Monomer contracts rose 7¢ in April to 75.5¢/lb. Spot prices collapsed, with propylene trading 10¢ lower than contract prices. May contract prices were expected to drop somewhere between 7¢/lb and 15¢/lb, with PP resin tabs to follow accordingly. In the secondary markets, sellers quickly began peeling off the pennies, with discounts up to around 20¢/lb, depending on grade.

Supplier operating rates and market demand both rose to 90% in April from previous lows of 80-81%, while inventories grew to 32.4 days. Falling domestic resin and monomer prices last month were expected to result in a possible rebound of exports, which had vanished by the end of the first quarter. An uptick in domestic demand was also anticipated as many buyers had thinning inventories.

Outlook & Suggested Action Strategies

30-60 Day: Prices are falling quickly and there is a general feeling that this trend may continue for the next few months. Still, we encouraged buyers starting last month to start looking for signs of bottoming out. Do not wait for the absolute bottom and risk missing out on good opportunities available now.

PS PRICES DROPPING

Polystyrene prices were flat in April and into May, despite posted price hikes of 4¢ to 5¢/lb, effective May 1. In fact, prices last month were heading down 1¢ to 2¢/lb, with an anticipated decrease of 2¢ to 3¢ more this month. Discounts re-emerged, with Ineos appearing to be the most aggressive.

Styrene monomer prices also dropped, with the March contract price down 5¢ to a range of 67.5¢ to 71¢/lb. Rising feedstock costs had driven suppliers to propose a monomer hike of 3-4¢/lb for the April contract. However, feedstock prices then subsided. Spot monomer prices in April stood at 58¢ to 60¢/lb. Monomer demand began to shrink in late April in anticipation of lower prices. Declining demand was also caused by lower consumption of other plastics like ABS, due to continued supply problems for butadiene, whose April contract price rose 8¢ to 84¢/lb.

Meanwhile, very tight butadiene supply is increasing the price spread between GPPS and HIPS. The premium for HIPS was expected to go as high as 6-7¢/lb in the short term and then return to 4-5¢ levels when butadiene supply recovers.

Wide-spec PS railcar prices are 68¢ to 73¢/lb for GPPS and 75¢ to 80¢/lb for HIPS. Distributor railcar costs remained unchanged at 89¢/lb for GPPS and 95¢/lb for HIPS from April to mid-May. EPS bead prices remained flat in April and early May.

GPPS and HIPS production rose 7% above 2009 for the first quarter, while EPS production gained 39%. End-use demand for both PS and EPS in the first quarter was up 64% in food packaging.

Outlook & Suggested Action Strategies

30-60 Day: Adopting a tight inventory strategy and exploring as many sourcing options as possible will help you enjoy lower pricing ahead of your peers. Expect PS prices to continue their downward trend in the coming months. Continue to buy as needed.

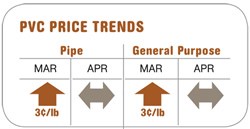

PVC PRICES FALLING

PVC prices moved up 3¢/lb in partial implementation of the March 5¢/lb hike and the remainder was to be implemented in April. However, the rapid downturn of ethylene monomer prices negated that effort and erased the planned April 5¢ hike. PVC buyers were looking for lower prices last month.

Declining ethylene monomer prices could drive PVC as much as a 10¢/lb lower in the second quarter, leaving prices close to last August’s levels. Meanwhile, domestic demand continues to improve, although housing and pipe have remained below normal.

Outlook & Suggested Action Strategies

30-60 Day: Lower PVC prices were expected through May and into June based on improved ethylene monomer availability and lower monomer prices. Although still well below normal levels, domestic demand will further improve. Ditto for export demand. Buy as needed, while looking out for ongoing resin price cuts.

Related Content

Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More

(2).jpg;maxWidth=300;quality=90)