PE Market Snap Shot: Converter Film

End use demands could drive growth of more complex, highly layered structures.

We’ve reported on stretch film, t-shirt bags, institutional can liners , consumer can liners, and shrink film, produce film, pouches and agricultural film in previous installments of this blog series, which provide snap shots of the results of 2017 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on the PE film industry. Here, we look at its analysis of converter film.

Converter film is designed to be utilized or converted into a multitude of different end-use applications or products. In its research, Mastio divides converter film into two categories:

Sheeting is cast film manufactured in gauges of less than 12 mils and sold to film converters, industrial end-users, or wholesale packaging distributors in the form of rollstock. Tubing is blown film that is sold as lay flat tubing on a roll. Tubing can be partially pre-finished, such as gusseted tubing.

During 2017, approximately 988.6 million lb of PE were consumed in the production of converter film, states Mastio. With an average annual growth rate (AAGR) of 2.3% projected by Mastio, PE resin consumption for production of converter film should reach 1.058.4 million lb by 2020.

Several film extrusion companies are periodically involved in this market, manufacturing converter on an “as-needed basis” to utilize excess capacity during slower periods of demand for other traditional PE film products. Other PE film extrusion companies reported manufacturing this film according to specifications by film converters or end-use customers. Some participants in this market extrude film only, while others extrude film and convert film into various packaging products.

According to Mastio’s research, last year the six largest participants in the converter film market were Sigma Plastics Group; Berry Global Group; Emballages Polystar (Polystar Packaging Canada Inc. Div.); Inteplast Group Ltd. (Inteplast Engineered Films Div./Engineered Films Div. and Danafilms Div.); Mid-South Extrusion; and IMAFLEX, Inc. Collectively, those companies had approximately 49.6% of the market in 2017.

Material Trends

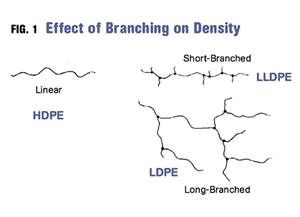

Overall consumption of LLDPE-butene, LLDPE-hexene, LLDPE-super hexene, LLDPE-octene, and mLLDPE resins have outpaced overall consumption of LDPE resin for this market, Mastio states. LLDPE yields greater impact strength and puncture resistance in lower gauges than LDPE. High clarity grades of LLDPE allow processors to produce films with high optical properties in thinner gauges than was previously possible with LDPE/LLDPE blends. This has further eroded LDPE’s dominance in this market.

According to Mastio, LDPEs were the second-most utilized material of choice to produce sheet and tubing, either utilized alone, in blends, or in multi-layer film coextrusion. LDPE’s characteristics of high clarity, ease of processing, low relative costs, and adaptability of blending with other PE resins are some of the reasons for its greater use. LDPE-copolymers, such as LDPE-ethylene vinyl acetate copolymer (LDPEEVA copolymer), LDPE-ethylene methyl acrylate copolymer (LDPE-EMA copolymer), and LDPE-ethylene acrylic acid copolymer (LDPE-EAA copolymer) resins will continue to be utilized in blends or in multi-layer film coextrusion with other PE resins.

Medium molecular weight-HDPE (MMW-HDPE), high molecular weight-HDPE (HMW-HDPE), and ultra-high molecular weight-HDPE (UHMW-HDPE) resins are extruded solely, in blends, or in film coextrusion with LDPE and LLDPE resins. HDPE resins allow even further downgauging, while providing even greater film strength than LLDPE resins. HDPE resin is also utilized as an additive in blends with LDPE or LLDPE, or as a processing aid to add stiffness and increase bubble stability in blown-film extrusion. This is especially helpful in bubble diameters greater than 80 in., Mastio states.

Additional benefits of utilizing HDPE resin are added barrier properties, excellent environmental stress crack resistance (ESCR), and greater ease for converting the film into finished bags or sacks. However, when implementing HDPE resin, some film clarity is sacrificed. Other resins reported in the market during 2017 included medium density PE (MDPE), polypropylene (PP), nylon, and ethylene-vinyl alcohol copolymer (EVOH).

Film Extrusion Technology

Mastio reports that during 2017, most converter film (99.1%) was produced utilizing the blown film process. Improvements in both film coextrusion and PE resin technologies have greatly increased the sophistication of PE films. A greater variety of film characteristics are now possible, such as a three-layer form, fill and seal sheeting with different levels of coefficient of friction (COF). The film can have outside high cling, inside high slip, and a sandwiched layer of LLDPE manufactured using the metallocene single-site catalyst process (mLLDPE). The high cling side helps prevent the packaged product from shifting or slipping after being stacked. The one side high slip allows greater ease of inserting the product into the package. The inner layer of mLLDPE resin allows faster production rates by affording greater hot tack strength than conventionally produced PE resins.

Film downgauging is another advantage of film coextrusion technology, by allowing film processors to combine LDPE with stronger LLDPE or HDPE resins. Coextruded converter film ranged from two-layer to nine-layer constructions, with the three-layer structure being the most typical.

My Two Cents

While films for this market are becoming more complex, the majority of converter-film structures—59%, according to Mastio—are still monolayer. This is bound to change as food suppliers in particular look to extend shelf-life. In the coex area, Mastio reports that three-layer structures are the most common. But as more demands continue to be place on the performance of the film, we may be seeing more five-layer structures and up in thRelated Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreIn Sustainable Packaging, the Word is ‘Monomaterial’

In both flexible and rigid packaging, the trend is to replace multimaterial laminates, coextrusions and “composites” with single-material structures, usually based on PE or PP. Nonpackaging applications are following suit.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreRecycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read More

(2).jpg;maxWidth=300;quality=90)