Articles

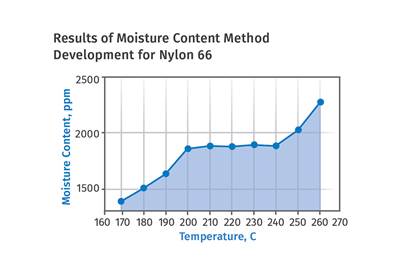

Unraveling the Science and Myth Associated With Moisture Analysis — Part 2

Once you’ve selected the right moisture analyzer, the task of method development begins. Don’t skip this step or you’ll run into problems. Here’s what happened in my lab decades ago.

Read More3D Printing Workshop Returns for NPE2024: The Plastics Show

The speaker lineup has been announced for this event highlighting the use of 3D printing in the plastics industry.

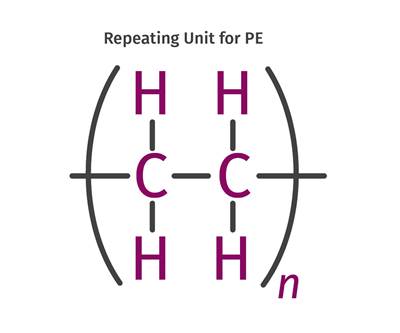

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreNew Blown-Film Cooling Technologies Set to Debut at NPE2024

Cooling specialist Addex to roll out new auto-profiling air ring for rotating dies, and new single-plenum air ring.

Read MoreNetworking at NPE2024: Opening Reception

For the first time ever, NPE will open with a reception: Monday, May 6 at 7-10 p.m. in the Valencia Ballroom, Orange County Convention Center.

Read MorePrices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreIn the Zone: Packaging

The Packaging Zone is the place to learn about the latest in customer product delivery.

Read MoreAustrian Recycler's Mission to Recycle PET Takes It Beyond Bottles

Mission PET supplements bottle-to-bottle capability with alternative applications for recycled PET.

Read MoreReal-Time Production Monitoring as Automation

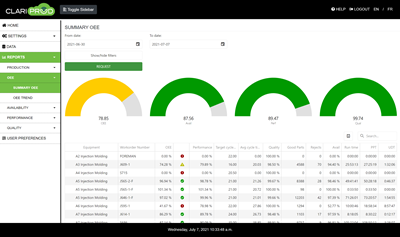

As an injection molder, Windmill Plastics sought an economical production monitoring system that could help it keep tabs on its shop floor. It’s now selling the “very focused” digital supervisor it created, automating many formerly manual tasks.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

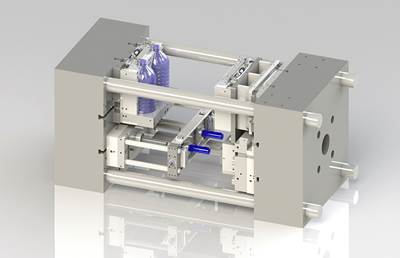

Read MoreAt NPE, Cypet to Show Latest Achievements in Large PET Containers

Maker of one-stage ISBM machines will show off new sizes and styles of handled and stackable PET containers, including novel interlocking products.

Read More